SIP (Systematic Investment Plan) Frequency & Timing

Quite often, we get the question - should we do the SIP daily, weekly or monthly. Sometimes, we're also asked if we do this on a particular day of the week, will it generate better returns? The short answer is...

It doesn't matter.

Over the long term (meaning 5,7 or 10 year horizon) — it doesn't make much difference whether it is daily, weekly or monthly. The difference is so small, you shouldn't even think about it.

For those who insist on weekly, we remind them that the paper work will be huge, as there will be a huge number of entries (52 weeks in a year x each fund). In short, your chartered accountant may charge you more ₹₹₹ for filing the Income Tax Returns, to compensate for his/her effort!

As a best practice at BayFolio - we select monthly by default, and we give the choice of either 1st of the month or 15th of the month.

Now, that is out of the way, there are still some curious as to what the data suggests, well, WhiteOak Mutual Fund did a study, and here is a summary of the results:

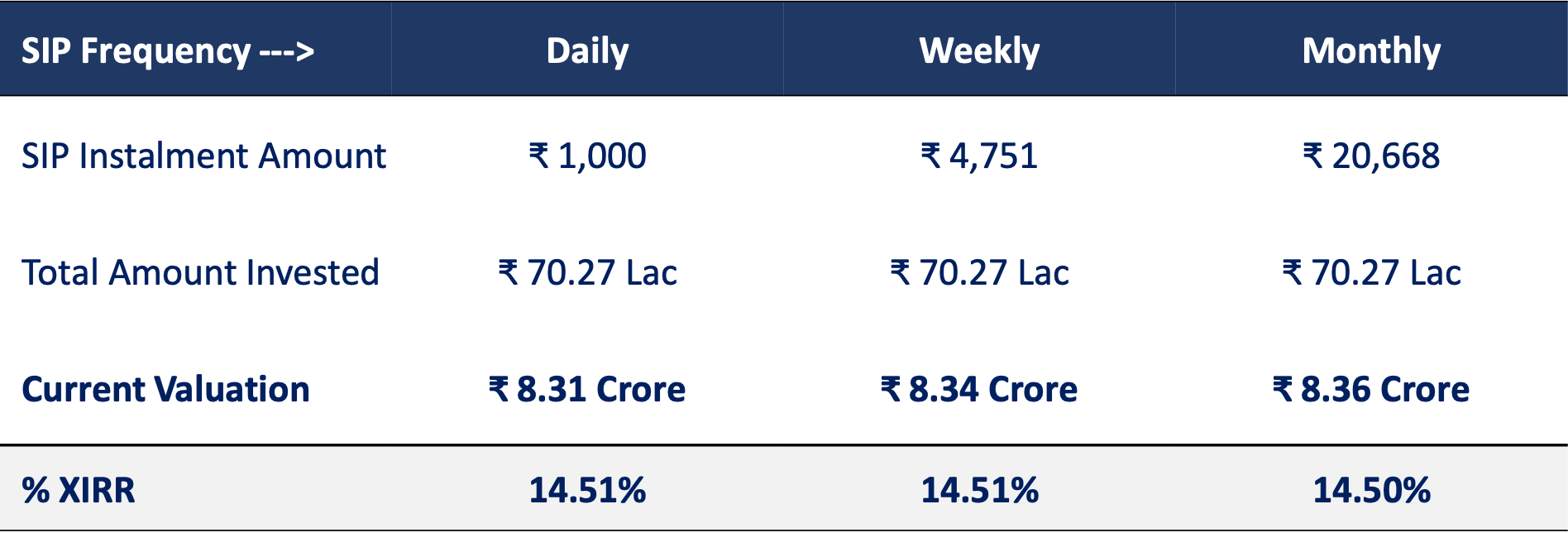

1) What is the best frequency to select for SIP - daily, weekly or monthly?

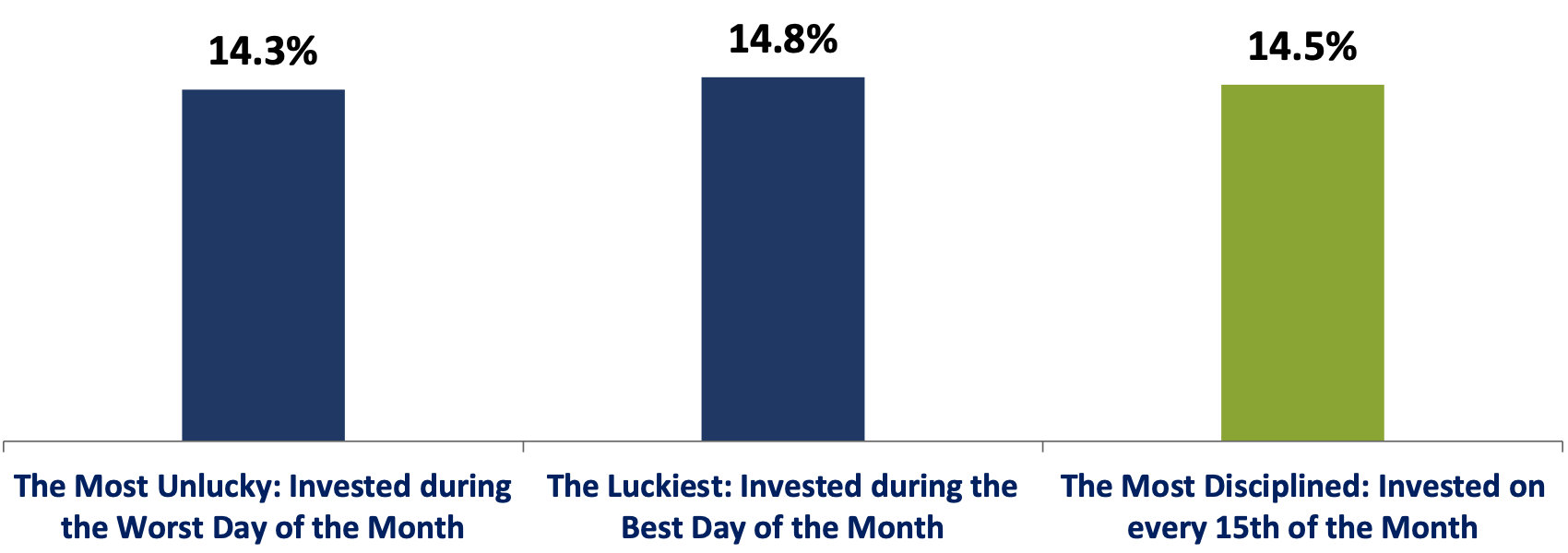

2) Which is the best date to do a monthly SIP?

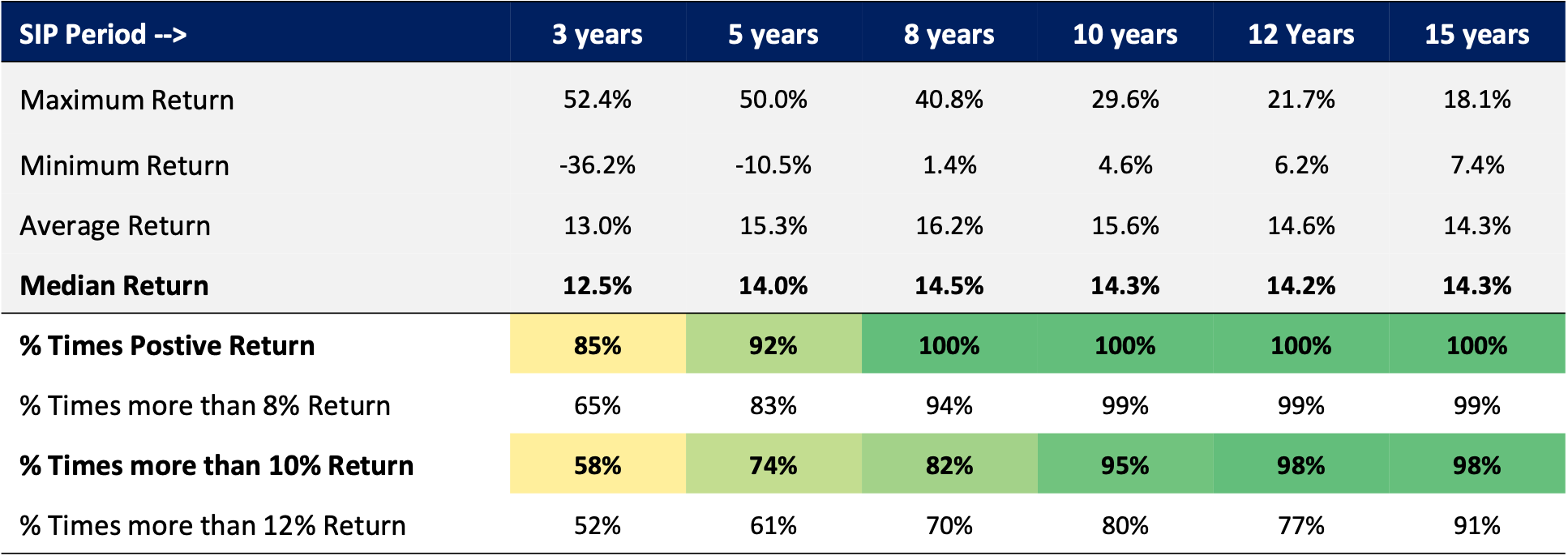

3) What is an ideal investing time horizon for SIP?

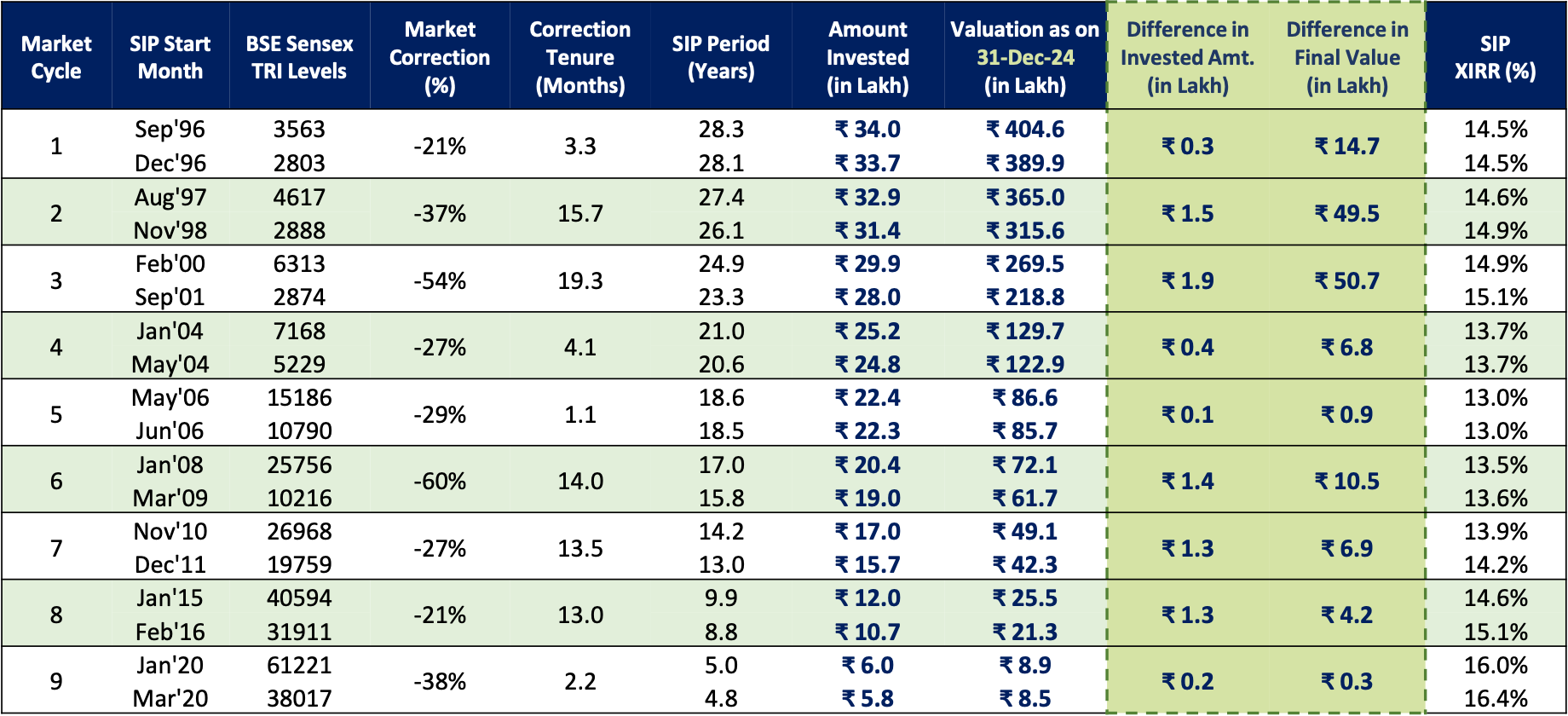

4) Which is better, starting SIP at the Top or Bottom?

5) Isn't it better if I time my monthly purchases?

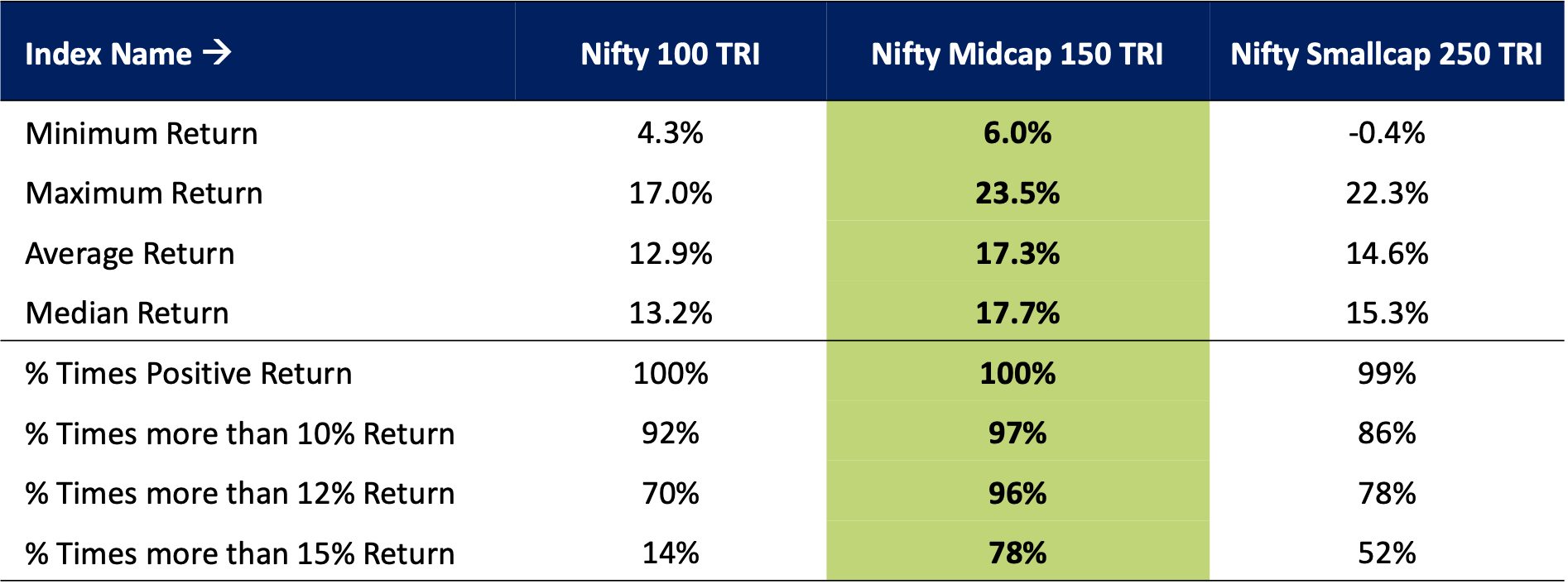

6) Large Cap, Mid Cap or Small Cap SIP?

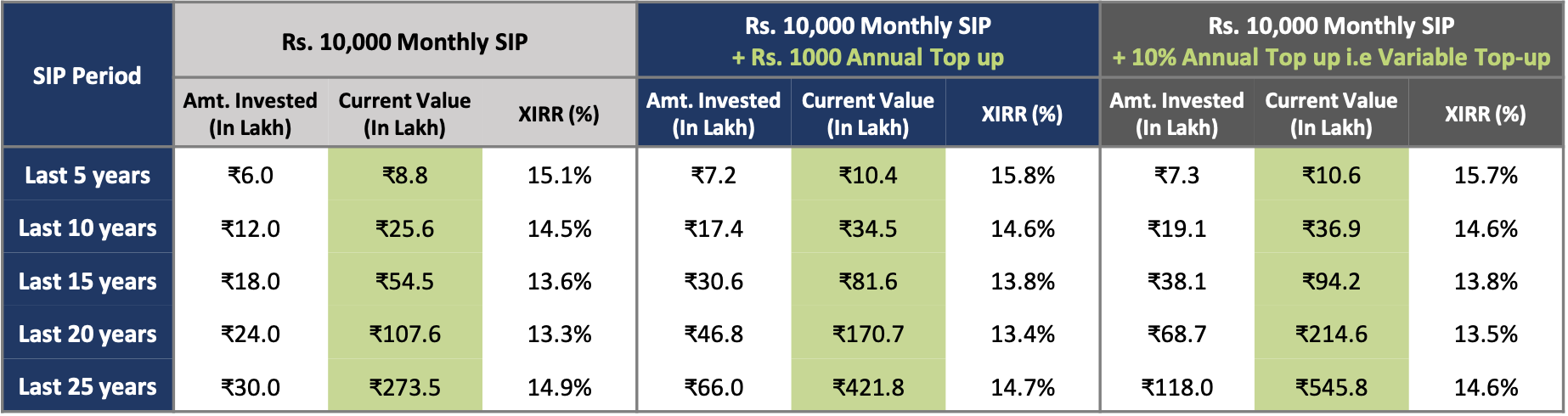

7) Should you opt for SIP TOP UP?

Member discussion