Why Choose Regular Vs Direct Plans

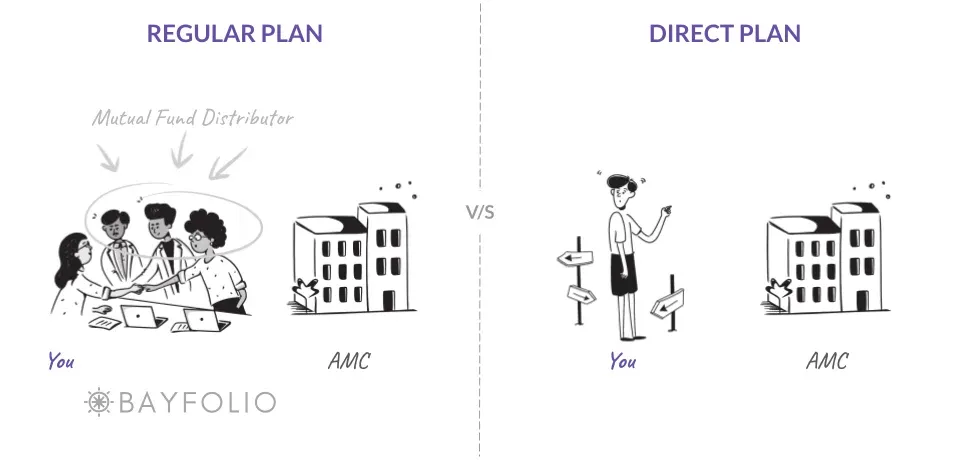

As a Mutual Fund Distributor (MFD), we are compensated by commissions from the mutual fund house a.k.a Asset Management Company or AMC as we call it.

This helps us cover our expenses. Read until the end, to learn how much we get.

These days many finfluencers online talk about going the direct plan route to save fees. Yes, over a long term you may save a bit. But you lose out on good advice.

What those finfluencers don't tell you is that when things go bad or you have a question – you have to desperately search the internet for answers, and even after many hours of researching – you won't find an answer for your personal situation.

You see, these finfluencers are usually trying to make you think they're saints, when actually they're trying to get "eyeballs" i.e. viewership, because higher the views, higher the advertising income. When something is free, you are the product.

Direct Plans are meant for DIY (Do It Yourself or as we like to say... Direct It Yourself) Investors.

Lost or too busy? There are over 1,000 schemes to choose from. They all look similar, and what happens after you buy? Who do you ask for help? Can you setup an STP (Systematic Transfer Plan)? How do you allocate?

What happens when you have to update your email/mobile, which RTA do you contact? How is your investments held, Demat or SOA? What's the tax implication when you sell? What happens when the market crashes - what do you do?

And many more such questions are addressed by an advisor or distributor.

At the end of the day, wouldn't you like to have someone take care of the nitty gritty, while you live your life! Life is too short to make it complicated.

Now, not all distributors are alike.

When you make a mutual fund investment through a bank-owned broking platform (app) – you are being offered regular plans, but without any advice!

So here are 3 key points why going the regular route might be best:

1. Expertise: Regular plans benefit from the expertise of financial experts (mutual fund distributors or advisors), which can be crucial for new or less experienced investors.

2. Personalized Advice: Distributors, though not permitted to give 'advice' as per SEBI, can give 'incidental advice' only related to mutual funds (there is an ongoing discussion on this). They can provide you personalized recommendations based on market conditions and individual financial situations.

3. Behavioral Support: When the markets start crashing or correcting – Advisors / Distributors can help investors stay disciplined during market volatility, which can lead to better long-term investment outcomes.

The last point is the most important. Which is why we will wear this T-Shirt just to remind you...

If you're already a client with us, you're in good hands! We look forward to partnering with you on your investment journey.

Member discussion